What is your investment style?

Are you a growth, value investor or something in-between?

Why should you have an investment strategy?

Investing styles are wide and varied (e.g. dividend investing, small-cap investing etc.) but there are 2 popular strategies which are growth and value investing. As a beginner investor, it is important to define your investment strategy to help you define what type of companies you’re really interested in, and to stay grounded through the ups and downs the stock market will throw your way. You can have more than one investment strategy and it does not have to be either growth or value investing.

Growth investing strategy

With growth investing, you’re trying to identify companies on a growth momentum, with lots of room to grow in the future. This strategy is focused on companies that have the potential to grow explosively in both size and importance within their industries. Typically, this can be reflected in their revenue growth rates, as growth companies are expected to outpace their peers in earnings and stock performance. Some metrics used to identify growth stocks are fast-growing revenues, increasing market share, management teams with a good track-record, growing TAM (Target Addressable Market) and a robust competitive advantage. Growth investors feel more comfortable paying more for what they see as significant growth opportunities as they expect to double their investment in the future (or triple).

Value investing strategy

In value investing, you’re trying to buy companies at prices less than their true ‘intrinsic’ value. The aim of the game is to sniff out stocks that are more valuable than what the current stock price dictates, buy them cheap and hope they go back up to what you think it should be priced at. As a result of buying stocks for a “discount”, value investors protect themselves against risk by their pre-defined Margin of Safety.

To understand if a stock is undervalued, you need to grasp its true ‘intrinsic’ value. Value-investors use a few metrics to unearth a company’s intrinsic values such as the Dividend Yield, Price to Equity (P/E) ratio, Free Cash Flow (FCF), Market Cap., Revenues and Profitability.

Your investing ‘style’ can be anything you want it to be

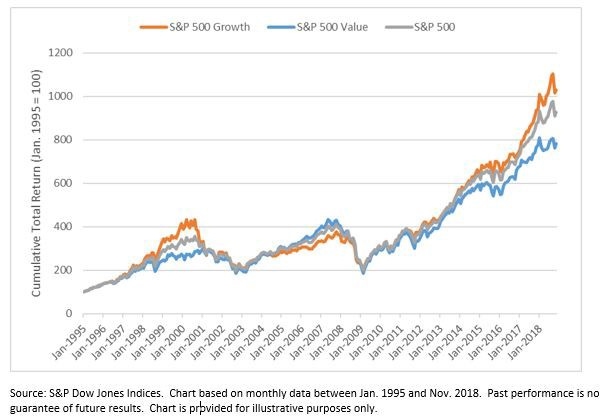

Over the last decade, growth has outperformed value stocks. Generally speaking, growth stocks are more volatile and because value stocks are considered cheaper, they are expected to decline less in a market downturn.

I think choosing to be either a growth or a value investor is an archaic form of investing that could lead to low or average returns. I think a forward-looking investor uses a blend of value and growth investing techniques. You need a good blend of quantitative analysis to find the intrinsic value and the qualitative analysis commonly attached to growth investing (fast-paced growth, innovation, market opportunity etc). This ensures you don’t overpay for a stock but also hold high-quality growing businesses.

Disclaimer: This is not invesment advice and if you would like investment advice, please seek a qualified financial adviser.